info@melding.co.uk

Investors' FAQS

Who is Melding Limited?

Melding Ltd was created by a group of passionate individuals who wanted to help as many businesses and individuals achieve their entrepreneurial goals and aspirations, via accessing commercial funding that was previously not available to them before. We are dedicated to providing a professional and efficient service to both our Lenders and Borrowers.

Melding Ltd (No. 8717078) and Melding Security Trustee Company Ltd (No. 9281426) are registered in England and Wales. Our trading address is Melding Limited, Kemp House, 152 City Road, London EC1V 2NX. Our registered office is 145-157 St. John Street London EC1V 4PW.

How is Melding Limited Regulated?

Melding Ltd is regulated by the Financial Conduct Authority (FCA) 661800 and is registered with the Office of the Information Commissioner, Reg no. A1023157. Melding Ltd is also regulated by the Anti Money Laundering Act of 2007.

Who Can Become a Lender?

Application to become a Lender is open to all but admittance is strictly vetted. If you are an individual you must be 18 years of age or over and reside in the UK. If you are a partnership, limited liability partnership or a limited company we will expect that you are correctly constituted and regulated. We will request ID, undertake anti-money laundering and anti-fraud checks which will comprise of standard identity checks and credit reference checks.

Part of the registration process is that all our Lenders confirm they are able to pledge a minimum amount of £50,000 per loan request.

If you are resident overseas, we are currently investigating ways that we can satisfy the stringent identity checks required by the Anti Money Laundering regulations for overseas residents. Watch this space!

What is the Minimum and Maximum Amount I Can Lend on Each Loan Request?

The minimum amount is £50,000 per request. The maximum amount is the loan application amount. What most Lenders will do is spread their available funds across a number of loans as this will ensure that your portfolio is well diversified and not overly concentrated in a small number of loans.

Do I have to undergo any credit checks?

We will need to confirm your identity before we can accept your registration. This requires us to conduct anti-fraud and anti-money laundering checks in line with legal requirements. On some occasions we may need applicants to supply additional information.

How Do You Ensure the Borrower Is Who They Say They Are?

We carry out all reasonable steps via a series of industry-standard checks to satisfy ourselves as to the identity of the borrower.

Do I Have to Prepare Any of the Legal Documentation?

One of the major benefits of using a professional service like we offer is we take care of all the administration and documentation.

What is the Process for Assessing an Application?

We have a logical four-step assessment process:

Step One: Upon the Application being received the information provided is reviewed and a ‘first pass’ decision is taken

Step Two: We will call the Borrower to confirm the nature of the request and ask supplementary questions

Step Three: Our due diligence process then differs from most Peer to Peer/Crowd funding platforms in that we arrange a face-to-face interview with the applicant. We feel it is important that we have the opportunity to meet the applicant or its representatives/officers in order to get a better sense of the business and the promoters.

The interview is also an opportunity for the Borrower to ask questions of us and our process.

If, following the interview and our further due diligence checks, if we are as satisfied as we reasonably can be that the request has merit, the proposal moves to the next step.

Step Four: Only after our due diligence process has been completed with the application be then sent for an independent external review. This step is undertaken by a group of specialist credit analysts with an extensive background in credit assessment. They will review the application from a number of perspectives and provide a recommendation to either support or decline the request.

It is important to understand that whilst we endeavour to cover all aspects of an applicant’s background and business it is ultimately your decision to support the request or turn it aside.

Who Will I Be Lending To?

We provide loans to UK based Limited Companies, LLPs and sole traders. We do not currently lend to business start ups. We’ll always let our members know if we decide to amend this basic principle before we start asking for applications of a new nature.

Can I Choose Who I Wish To Lend To?

Absolutely. Like most great peer to peer businesses, the ultimate decision on whether you wish to lend on a transaction is always with yourself. You have total choice.

Can I Request Additional Information Before I Decide Upon My Final Decision?

Definitely. We don’t want anyone to take a decision where they don’t feel that they have all the information they need to make a sensible decision based upon all the facts available.

We’ll make every effort to get any additional information that you require, and where it may not e forthcoming for whatever reason, you always have the right to decide that the deals is not for you. At ultimate goal is to ensure that you feel totally comfortable before you make any decision of investing your funds.

What Information Do We Get About the Borrower, Their Business and the Loan Request?

In order for you to make an informed decision on whether to lend to you or not we will provide you with the following information:

• The borrower’s name, business name, or the name they trade under

• The legal status of the business i.e. sole trader, partnership, limited liability partnership or limited company

• Description of the business

• Details of existing borrowing

• A summary of financial performance to include Annual Accounts, Management Accounts and projections

• The purpose of the loan

• The amount requested

• Repayment term

• Monthly repayment amount

• Credit Rating Score Band

• Type of security being offered

• The Credit Assessment Team’s recommendation

• Any other information deemed to be helpful in assisting to reach a decision

Am I Investing Into A Fund?

No, your money is not being invested into a collective pool of money. Each loan you decide to support is on a standalone basis.

How Do You Arrive at the Risk Grade?

Each loan proposal and business has a different level of risk; some will be low risk and others of a higher risk. The differing levels of risk are reflected in the interest rate and so each loan request is assigned a risk band and this is done via a Credit Rating Score Band (CRSB).

The CRSBs are:

A – Low Risk

B – Medium Risk

C – Average Risk

D – Higher Risk

In order to avoid applicants attempting to present information in such a way as to improve the CRSB we do not disclose how they are calculated. However, key factors include:

• Age of the business

• Director’s/owner’s experience

• Financial performance from Annual Accounts and Management Information

• The business/directors/owner’s external credit rating and past credit history

• Type of security (if any) offered and the valuation

• The industry sector

Whilst we can put a series of parameters in place to assess the level of risk ultimately it’s down to you as to whether you agree or disagree with the CRSB. You need to arrive at your own view as to the perceived level of risk and whether you are comfortable at that level before decide to support the request.

Where Do I Send My Share of a Loan Request and How Is It Held?

We act as the go-between. Your money is held in a designated Client Account pending disbursement to the Borrower (after all documentation and security is in place). Once you become an approved Lender, you’ll be given instructions on the precise details of where to remit your funds to.

How Am I Paid Back?

We will act as the collection agent for receipt of the monthly payment. When funds are received the capital and interest portion of the loan are credited to an internal client account held on your behalf. We will then remit the funds to your nominated UK bank account within 15 days after confirmed receipt into the client account.

What Return Will I Get on the Money I Loan?

Unlike some peer-to-peer lending platforms we do not run a bidding process; we determine a Credit Rating Score Band for each application and each band has a fixed interest rate. In this way you immediately know what your return will be.

From a portfolio perspective you will have to discount any losses made on individual loans and other costs which may be incurred, to arrive at your overall rate of return.

Is Tax Deducted From the Interest I am paid?

No, your interest is paid gross via the monthly repayment you receive. It is up to you to account for the interest you receive via the normal tax reporting procedures. If you are unsure about your tax position we recommend that you seek independent professional advice.

How Long Will I Have To Invest For?

Loan applications vary in length. Typically on our platform they can run anywhere from 3 months to 5 years.

The important point to note is that you always have the choice on what you decide to invest in, at the outset, so if a particular loan doesn’t fit your criteria, in terms of a payback period, that’s fine. Just review the next application until you find one that fits into your criteria.

Do You Charge Lenders Any Fees?

There are no fees for Lenders to register or to participate in a Loan request. There is an annual flat fee of £100 to cover administration costs and this is deducted from your account held with us on the anniversary of you becoming a Registered Lender.

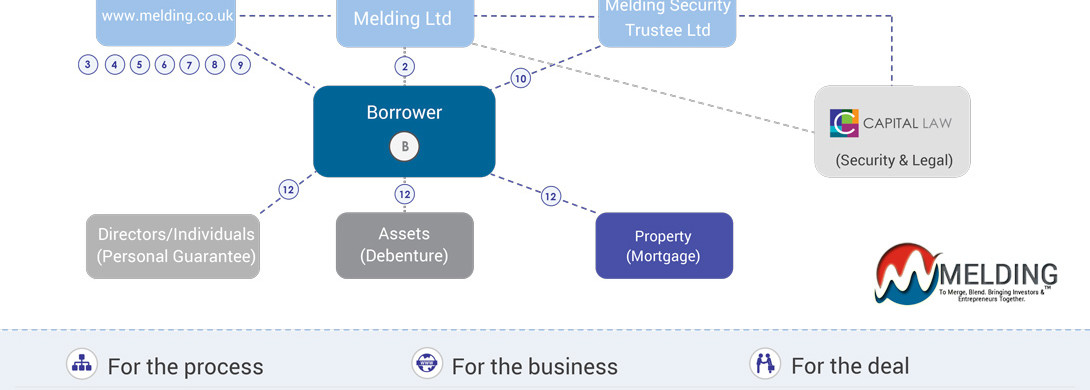

How Is the Security Taken?

All borrowings are secured against some form of asset class (depending upon what the loan is being appropriated for). The security documentation will be drawn up by a Solicitor and will be held by a Security Trustee company (Melding Security Trustee Ltd) for the benefit of the Lenders on a pro-rata basis of the loan amount.

How Secure Is Your Legal Documentation?

This is one area in particular where it pays to have the best team in your corner, which is why we decided to use the services of Capital Law to assist in the best securitisation documentation and process that we believe is on offer in the UK. This is our opinion but please feel free to do your own due diligence. Here’s a link to there website www.capitallaw.co.uk.

How Long is the Lender Review Process?

All the documentation relating to a Loan Application is available to you for review. Because loans are offered on a fixed interest rate (depending on the Credit Rating Score Band) there is no bidding process, so it’s on a ‘first-come-first-served’ basis. Once a loan is fully funded the funding process is closed. Typically a loan will be funded within 5 to 7 working days.

If a Borrower Fails to Pay Back or the Business Fails How Am I Protected?

Firstly, it is important to understand that utilising your money via lending attracts a risk. Whilst we have a credit assessment process you have to be prepared for an element of loss due to events which may occur after the initial approval is granted.

In circumstances where a borrower does default, a debt collection firm will be appointed on your behalf and you, together with your lending partners, can chose to follow this with appropriate legal action.

Where security is held, the security trustee is able to exercise your rights under the terms of the security documents. Remember that the value of any security can go down as well as up.

Register Now to see if you meet the Criteria

Melding Ltd (No. 8717078) and Melding Security Trustee Company Ltd (No. 9281426) are registered in England and Wales. Trading office is Melding Limited, Kemp House, 152 City Road, London EC1V 2NX. Registered office is 20-22 Wenlock Road, London N1 7GU.

Melding Ltd is regulated by the Financial Conduct Authority (FCA) 723131 and is registered with the Office of the Information Commissioner, Reg no. A1023157. Melding Ltd is also regulated by the Anti Money Laundering Act of 2007. Melding Ltd or any of its associated companies are not covered by the Financial Services Compensation scheme.

Risk Warning: Investments through Melding Ltd involves making direct loans to individuals and companies. You could lose all or part of your capital. Prospective Lenders should note that past performance should not be seen as an indication of future performance. The value of a loan and the income from it can fall as well as rise and Lenders may not get back the amount originally loaned. Therefore you should only make investment in unlisted companies which you can afford to lose without having any significant impact on your overall financial position or commitments. Taxation levels, bases and reliefs may change if the law changes and independent advice should be sought. We will not have any liability for any legal, investment or tax issues in connection with any loan you decide to make through our website.

You could lose all or part of your capital.

Melding Ltd is targeted exclusively at investors who are sufficiently sophisticated to understand these risks and make their own investment decisions. You will only be able to invest via Melding Ltd and Melding Security Trust Ltd once you have agreed to our standard terms and conditions and are registered on our records as a sufficiently sophisticated investor.