info@melding.co.uk

Benefits of using our Services

Melding Limited was created to give both Lenders and Borrowers and alternative Peer to Peer service, where the computers don’t make the decisions! The business prides itself on the fact that we get to know both sides of each transaction, to ensure both a financial and a commercial fit.

You could say it's back to basics - simple face-to-face communications.

Secured Lending

We believe in reducing the risks of any loan, which is why we only deal with Asset backed loans. All Entrepreneurs whom we deal with understand this key principle.

Keeping it Simple

Which is what we believe any Investor or Entrepreneur wants when it comes to making money. We take the hassle out of 'doing the deal'!

Maintain Your Focus

You focus on what you’re good at and let us help you achieve your goals and objectives with our professional bespoke service.

You're in Control

Our service is here to guide you through all the legalities and administration but the important part is that at you are in control of the application process.

Entrepreneur's Process

Register as an Entrepreneur

Register with us to become one of our Approved Borrowers (Entrepreneurs). It’s simple and quick.

You can then start to enjoy the services that we have to offer by giving you the ability to fund your profitable business ventures.

↓ Click below for further details.

The Application Process

1. Download and complete a registration form to become an approved Borrower and submit to us with any required information

2. Once we receive your completed registration documentation, well arrange a brief online interview to ensure that we understand your expectations and for our own internal compliance purposes

3. As you’d expect, this process will involve Melding Ltd confirming and qualifying that you are who you say you are and that you can satisfy the various criteria that are laid down by the FCA and AML compliance. For more details click here.

4. Well then quickly review your registration and let you know whether your account has been approved

We’d hope that this process should be completed in a timely manner but we don’t believe in rushing into business relationships, as we are sure that you’d rather have long term contacts with businesses that you know and trust, who do things the right way, as opposed to many short term, time consuming acquaintances’.

Register Now to see if you meet the Criteria

The Loan Application

Once you are an approved Borrower, you’ll now be able to pitch your business proposals to our approved Lenders in a structured and logical way.

↓ Click below for further details.

The Loan Application Process

1. One of the first things we’ll need you to do is to complete one of our standard application forms that will pull together all the information that we’ll need in order to assess your application. Don’t worry, we’re here to help so don’t be afraid to ask!

2. We’ll let you know the type of documents that will be required to support your application and they’re likely to include your latest accounts, property details, etc.

3. We’ll then arrange a quick call to ensure we have everything and understand your requirements

4. At this point we will be in a good position to let you know whether we believe we can move your application forward based upon all the information received to date (in the various forms)

5. Assuming that all is well, you’ll then be asked to pay an Application fee, for two reasons;

a. Firstly to cover the amount of time that we invest in all our loan applications and

b. Secondly, frankly to avoid anyone wasting our time by applying on multiple platforms without any consideration for each firms costs. Apologies for being so honest but that’s what we are – fair and frank!

Review the Detail

Having past all the initial reviews, in collaboration with our Credit Assessment Team, we’ll be able to place a level of expected risk on your application based upon our credit policy and all the information that we have to hand.

↓ Click below for further details.

The Review (Due Diligence) Process

1. One of the first things that we’ll do is to arrange a face to face meeting to go through your application in detail. This way we can ensure that we can represent your proposal correctly to our Lenders and allows us to fully appreciate your project.

2. Your application will then be sent to our Credit Assessment Team who will do an Independent review of our Internal credit assessment

3. At this point, your Application will be given a Credit Rating and you’ll be informed of our decision

4. You then can decide whether you’d like to proceed to Funding or not. Always your choice.

5. Once we have your acceptance to your credit rating, we’ll then inform ALL our approved Lenders of your project and move quickly to get it funded as quick as possible.

Remember, our responsibility is to ensure that we only put forward to our lenders, applications that we believe offer a considered risk profile that allow for their capital and interest to be repaid without any interruption or default.

Also, although we shall be rating your application, we always require our lenders do there own due diligence on the facts we put to them before they finally come to a decision on funding or not.

The Funding Process

Once we’ve completed our internal due diligence, we’ll put your application live on our platform so that our Lenders can review and make a decision upon funding your project.

↓ Click below for further details.

The Deal Process

1. Once our Lenders have completed their own due diligence, we’ll then ask them to either confirm or reject the funding request

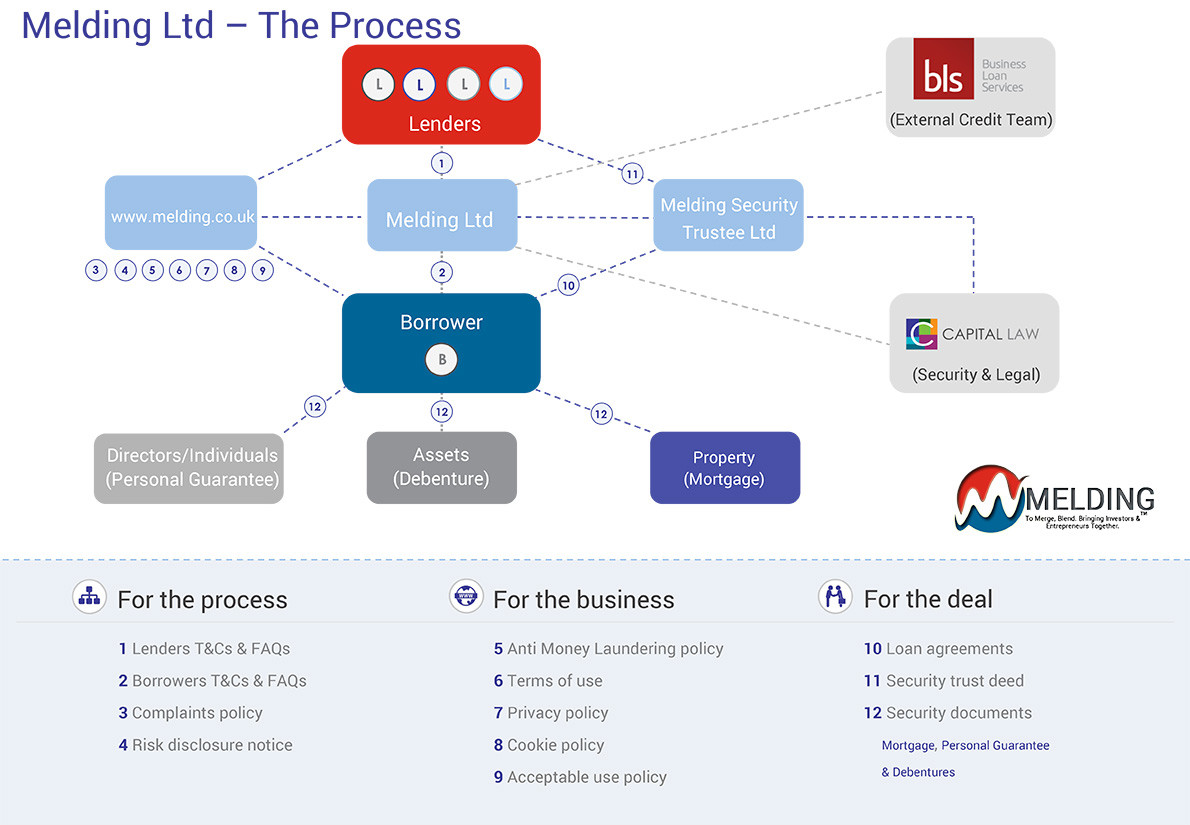

2. We’ll then employ the services of our retained legal council (Capital Law) to instigate and review any Security documentation that would stand as security against the loan agreement. The cost incurred will form part of the Loan Application fee. We attempt to keep this to a maximum of 1.5% of the loan amount but will depend largely on how complicated or difficult the securitisation of the transaction is

3. Well then try to ensue that your Project gets full funding

4. You’ll then have the opportunity to review the Loan and Security documents to ensure that you are satisfied with there form and then formally give us your acceptance

5. Only after having received the following will the funds be released from our client account;

a. Signed Loan Agreement

b. Signed Security Documentation

c. Settled Loan Arrangement Fee

6. Once the above have been completed, funds can then be drawndown

7. Melding Security Trust Limited will hold signed copies and will act as Trustee and Agent for all Lenders

8. We’ll then monitor all your repayments

Melding Ltd (No. 8717078) and Melding Security Trustee Company Ltd (No. 9281426) are registered in England and Wales. Trading office is Melding Limited, Kemp House, 152 City Road, London EC1V 2NX. Registered office is 20-22 Wenlock Road, London N1 7GU.

Melding Ltd is regulated by the Financial Conduct Authority (FCA) 723131 and is registered with the Office of the Information Commissioner, Reg no. A1023157. Melding Ltd is also regulated by the Anti Money Laundering Act of 2007. Melding Ltd or any of its associated companies are not covered by the Financial Services Compensation scheme.

Risk Warning: Investments through Melding Ltd involves making direct loans to individuals and companies. You could lose all or part of your capital. Prospective Lenders should note that past performance should not be seen as an indication of future performance. The value of a loan and the income from it can fall as well as rise and Lenders may not get back the amount originally loaned. Therefore you should only make investment in unlisted companies which you can afford to lose without having any significant impact on your overall financial position or commitments. Taxation levels, bases and reliefs may change if the law changes and independent advice should be sought. We will not have any liability for any legal, investment or tax issues in connection with any loan you decide to make through our website.

You could lose all or part of your capital.

Melding Ltd is targeted exclusively at investors who are sufficiently sophisticated to understand these risks and make their own investment decisions. You will only be able to invest via Melding Ltd and Melding Security Trust Ltd once you have agreed to our standard terms and conditions and are registered on our records as a sufficiently sophisticated investor.